What does this error mean?

You will receive error when the FBI Sender details entered in VAT Submission Pro do not match the details stored on the HMRC website.

What should you do?

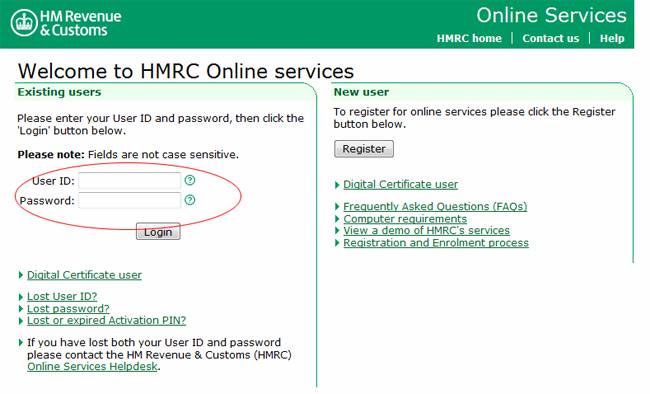

Recheck the details entered in VAT Submission Pro. The ‘Sender user id’ and ‘Sender password’ are the details you use to log into the online services on the HMRC website.

If you have not registered with HMRC to use their online services, visit their website , click the VAT Online link in the 'do it online' section and follow the on screen prompts.

Agents filing on behalf of a client will also have to complete the online agent authorisation. Below is a quick guide.

Online agent authorisation – VAT

To file online for your client, you just need to go through the online agent authorisation process (this is required even if your client has already completed a paper authorisation 64-8 covering VAT). Note that clients no longer have to enrol themselves for HMRC online services and get their own government gateway login before you can apply to file online on their behalf

To complete the authorisation process you will need your clients’:

- VAT registration number

- Principal place of business postcode (for overseas businesses, the postcode shown on their VAT4 certificate of VAT registration)

- Effective date of registration for VAT

- Final month of the last VAT Return submitted

- The box 5 figure on the last VAT Return submitted

Most of these details will be readily available. If neither you nor your client can find the VAT 4 (the client's certificate of VAT registration) which contains the effective date of registration information, your client can obtain a copy by contacting HMRC on 0845 010 9000. Beware - this information cannot be given over the phone, so allow extra time for the copy certificate to be posted to your client and then forwarded to you.

Once you have these five pieces of information, login to the online service, and in the 'Your services' section, click on the 'authorise client' link and follow the on-screen instructions.

HMRC will send your client a letter for each service that you have set up authorisation for. The letter contains a unique authorisation code you must use within 30 days, so it's important to tell your client to expect the letter and to let you have the code so you can enter it online and complete the authorisation process.

New VAT clients will appear on your client list within 24 hours of completing the authorisation process.